HDFC Bank’s balance sheet has crossed Rs7 trillion, narrowing the gap with ICICI Bank

Just like former Australian bowler Glenn McGrath used to land ball after ball in the same spot outside the off stump, HDFC Bank Ltd has unerringly posted another quarter of 20% net profit growth. If there was any mild excitement around its March quarter earnings, it was the utilization of around Rs.300 crore of floating provisions towards two accounts.

Half of this provision was on account of a central bank directive to all lenders to set aside 7.5% of their exposure to the Punjab state government, which is battling a foodgrain scam. It has to make a similar provision in the first quarter of this financial year. That said, at the end of the day, as the lender’s management clarified in a conference call, this loan has been made directly to the state government and would be classified as sovereign debt.

There was no untoward effect on HDFC Bank’s credit costs either. Annualized credit costs came in at 47 basis points in the March quarter, a decline from both a year ago and the previous quarter’s number. One basis point is one-hundredth of a percentage point. The bank maintained its asset quality performance with gross non-performing loans remaining under 1% of its advances.

Other performance yardsticks hit the mark as well. Return on assets was 1.9% and cost-to-income ratio under 45%. The bank’s net interest margin was 4.3%; the management said the move to the new marginal cost of funds-based lending rate was unlikely to affect margins much. It reiterated its usual guidance of 4-4.4% margin for the current quarter as well.

With this set of numbers repeated quarterly, the trigger for stock performance is balance sheet growth. HDFC Bank’s balance sheet has crossed Rs.7 trillion, narrowing the gap with ICICI Bank. In the March quarter, loans grew 27%, about two-and-a-half times industry growth and especially creditable for a loan book of this size. Retail loans—driven by personal loans and home loans—grew by 30%. Deposits also grew faster than the industry at 21%.

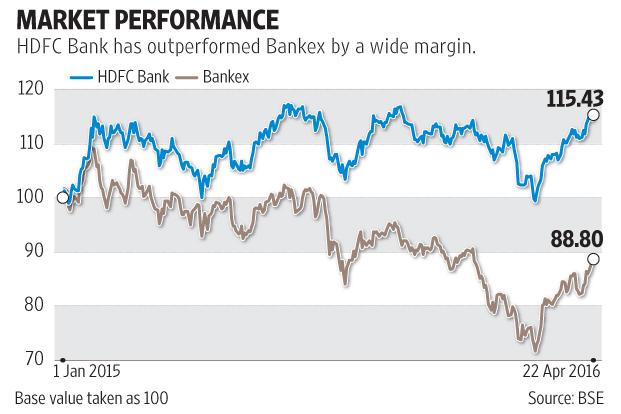

While HDFC Bank shares trade at 3.3 times their expected book value for this financial year—among the most expensive in the world—it is its ability to disregard the operating environment that allows the stock to outperform the benchmark Bankex.

Sun Capital

No comments:

Post a Comment