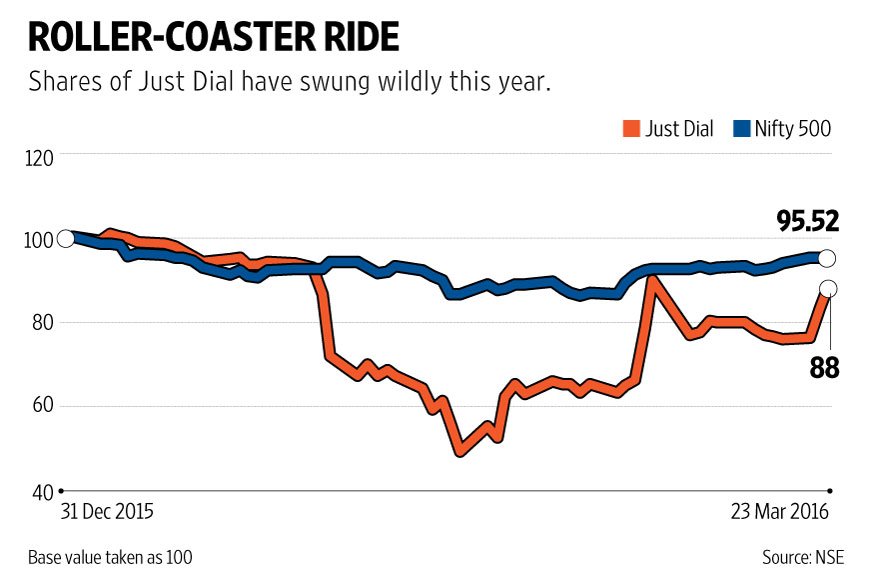

While markets have been volatile this year, Just Dial’s swings are out of the ordinary and investing in its shares is clearly not a great idea for the faint-hearted.

One of the reasons for the high volatility in the shares of Just Dial is the large variance in valuations ascribed to the Search Plus business and its attempt at capturing the growth of e-commerce in the Indian market.

One of the reasons for the high volatility in the shares of Just Dial is the large variance in valuations ascribed to the Search Plus business and its attempt at capturing the growth of e-commerce in the Indian market.

Shares of Just Dial Ltd have had a roller coaster ride this year. First, they halved from around Rs.840 at the beginning of the year to Rs.415 in mid-February. Since then, they have rallied back to around Rs.740. While the markets have been volatile this year, Just Dial’s swings are clearly out of the ordinary. Investing in its shares is clearly not a great idea for the faint-hearted.

One of the reasons for the high volatility is the large variance in valuations ascribed to the Search Plus business and its attempt at capturing the growth of e-commerce in the Indian market. Earlier this month, analysts at Nomura Financial Advisory and Securities (India) Pvt. Ltd changed its valuation methodology for this business.

Instead of valuing it separately as a multiple of estimates gross merchandise value (GMV), the broker now values the entire Just Dial business using the traditional forward price-earnings multiple. This is, in part, “to better capture the pushback in the Search Plus business”. The full launch of this business has been delayed for about a year now.

Even so, Nomura remains sanguine about Search Plus, and believes it will improve the prospects of the core business as well. Jefferies India Pvt. Ltd’s analyst, on the other hand, has been underwhelmed after using services that are already available on the platform. “We expect limited traction from Search Plus which could lead to continued disappointment on revenue growth and margins,” the broker said in a note to clients.

But this isn’t the only reason for the volatility in Just Dial shares. Just Dial’s core business has been under pressure lately, with growth dropping to 11% in the December quarter, compared with the company’s own guidance that growth will be between 25-30% this fiscal year. Some analysts believe the company’s problems in the core search business are owing to execution issues, which can be corrected, while some others have taken the view that the problems are structural and will be difficult to reverse.

The company faces tough competition from some sector specialists such as Practo.com in the healthcare space and Zomato.com in the restaurants space. Customers are likely to prefer these venues for searches in those domains, which can continue to eat into Just Dial’s growth. The company, however, has told analysts at Nomura that “its exposure to any particular category is not more than 2-3% and it has not seen an impact on categories like doctors or on-demand services, which remain healthy for the company”.

Besides, Just Dial’s customer churn rate is as high as 40%, which means new customer additions need to be rather high to compensate for the churn. The company’s version is that it mistimed hiring for its sales force, and this has impacted growth.

The bounce-back in Just Dial’s shares suggests that some investors are buying into the company’s reasoning. However, the proof of the pudding, as it’s said, is in the eating. Just Dial should now demonstrate a bounce back in its growth rates as well.

No comments:

Post a Comment