Suncapital: At two downgrades a day, the quality of India Inc’s debt is fast deteriorating. Thanks to160 downward revisions in the last two months alone, the tally since April 2015 has crossed 655 companies; metals, power, construction and infrastructure players lead the pack. And between January and now, rating agencies have made at least 13 revisions across seven state-owned lenders.

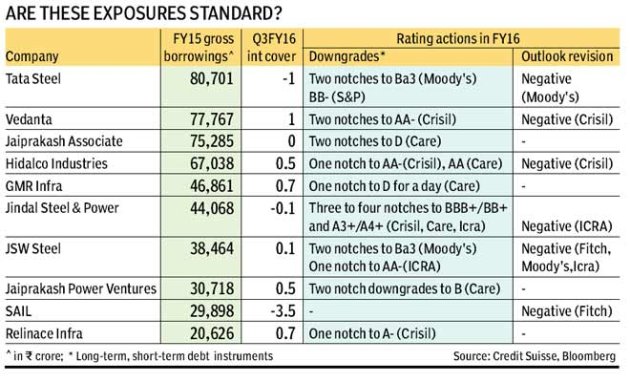

Jindal Steel and Power(JSPL), which owes lenders Rs 42,000 crore, is now rated below investment grade by CRISIL with the firm’s long and short-term credit rating now down by three to four notches. In mid-February, Moody’s lowered the long-term corporate family rating of Tata Steel by two notches to Ba3; soon thereafter, S&P revised downwards the grade of Vedanta Resources’ long-term foreign issuer credit rating to B, the fourth time this fiscal, citing increased pressure on liquidity as the firm attempts to refinance $1.35 billion of borrowings.

Moody’s lowered its outlook on Delhi International Airport Private Ltd’s Ba1 corporate family rating and senior secured ratings to ‘negative’, citing the impact of a new tariff order by the Airports Economic Regulatory Authority (AERA). It estimated that the new tariff guideline, applicable over 2016-2019, will lead to a decrease in annual aeronautical revenues by about R2,000 crore, or around 70%, from FY17 onwards. Among others for whom the outlook has been lowered to ‘negative’ are BHEL, DLF, Lodha Developers, Tata Tele Services and Shree Renuka Sugars.

As many as 16 sugar companies and 22 textile-linked companies have also seen rating revisions, as have several key infrastructure projects based on tariff changes or lower traffic volumes.

Given the dire situation that the steel sector is in, it’s not surprising that as many as 20 steel-producing and processing companies have been downgraded to ‘D’ or default rating in FY16 so far, according to Bloomberg data. The proportion of corporate debt owed by stressed companies, defined as those whose earnings are insufficient to cover their interest obligations, has increased to 41% in December, 2015, up from 35% in December 2014.

ICRA revised its outlook on the long-term rating of Mumbai Metro One, a special purpose vehicle (SPV) of Reliance Infrastructure, with two other entities, from stable to negative citing the shortfall in cash flow position of the project, resulting from lower than estimated actual daily passenger volume.

CRISIL Ratings identifies two clear trends in credit quality that have emerged over the past one year. The debt-weighted credit ratio, or the ratio of quantum of debt upgraded to that downgraded, is at its lowest level in nearly three years. This is because some large corporates — whose fortunes are linked to commodity and investment cycles — or those which are highly leveraged, remain stressed. What’s positive is that several mid-sized and smaller firms have seen an improvement in credit quality, with upgrades higher than downgrades, and the credit ratio touching a four-year high in the first half of fiscal 2015-16.

However, as demand slow-down and leveraged balance sheets of some Indian corporates limit their spending capacity, the cascading impact may not be ruled out even on smaller companies.

In a recent interaction , Bharat Iyer, MD & Head of Research at JP Morgan, pointed out that the de-leveraging cycle is taking longer in the absence of a revival in earnings and the inability of companies to raise equity. Which is why although the NPL cycle looks like it’s closer to the bottom, it could be some time away from turning. “Apart from sectors such as real estate, infrastructure and resources, there is also stress in the SMEs linked to these sectors,” Iyer added.

CRISIL had downgraded debt worth R2.4 lakh crore in the six months to September with the the debt-weighted credit ratio for a set of 1,441 companies — for which ratings were altered — falling to 0.27 times. For FY15, this ratio stood at 0.62 times. For FY16, a further deterioration in the gauge cannot be ruled out as companies struggle to make ends meet.

The metals and mining was clearly the worst affected space given that almost a quarter of default ratings belonged to such entities.

Ratings plunge

* Ratings for 655 firms downgraded since April 2015

* JSPL rated below investment grade, owes lenders R42,000 crore

* Tata Steel downgraded two notches to Ba3 by Moody’s

* Vedanta Resources downgraded by S&P to B

* Dial’s outlook lowered to ‘negative’ by Moody’s

* Outlook for BHEL, DLF, Lodha, TTSL, Shree Renuka Sugars lowered to ‘negative’

* 13 revisions for seven PSBs since January

No comments:

Post a Comment